China’s GDP growth target and why US tariff war will not work on China – Jeffrey D Sachs

by ShanghaiEye [3-5-2025 published].

(Be sure to review the additional included articles for this post. Going too far with sanctions & tariffs on China could seriously impact the US economy & our defense needs in many ways. Some of the critical minerals we get from China can't quickly be obtained elsewhere and we don't have adequate supplies in our country. — RAD)

Professor Jeffrey D. Sachs, Director of Center for Sustainable Development at Columbia University, speaks exclusively to ShanghaiEye as China sets its 2025 GDP growth target at around 5 percent. He also talks about the root cause of the US protectionist tariff war and why it will not work on China.

China responds to US tariffs

by RT [3-4-2025 published].

Beijing has introduced levies on American goods in response to Washington’s placed on Chinese products.

Beijing has slapped tariffs of up to 15% on various food commodities imported from the US and expanded controls on doing business with American firms. The move comes in response to Washington’s latest tariff hikes on Chinese goods.

On Tuesday, the Chinese Commerce Ministry announced 15% levies on imports of chicken, wheat, corn and cotton from the US, as well as 10% tariffs on American sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables, and dairy products. The measures come into effect on March 10, according to the ministry’s statement.

At the same time, the Chinese government placed 15 US companies under export and investment restrictions, citing national security concerns. Beijing has also initiated legal action against Washington with the World Trade Organization (WTO), claiming that US unilateral tariffs violate the organization’s rules and undermine the foundation of economic and trade cooperation.

Earlier this week, the US doubled tariffs on all Chinese imports from 10% to 20%, citing the country’s alleged role in the production of fentanyl, a deadly synthetic opioid.

On Tuesday, Chinese Foreign Ministry spokesman Lin Jian called the fentanyl issue “a flimsy excuse” to raise US tariffs on Chinese imports.

“The US, not anyone else, is responsible for the fentanyl crisis inside the US. In the spirit of humanity and goodwill towards the American people, we have taken robust steps to assist the US in dealing with the issue... Instead of recognizing our efforts, the US has sought to smear and shifted the blame to China, and is seeking to pressure and blackmail China with tariff hikes,” the spokesman said.

Washington’s action and Beijing’s response are seen by economists as another round in a large-scale trade war between the world’s two biggest economies, initiated by US President Donald Trump during his first presidential term. The cumulative 20% duty introduced this year comes atop tariffs of up to 25% imposed by his administration on some $370 billion worth of US imports from China in 2018 and 2019.

Related

Trump doubles China tariffs [3-4-2025]

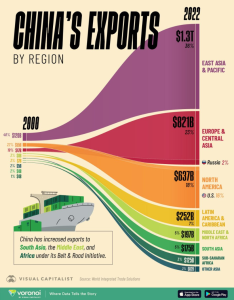

The US Represents Only 16% of China's Exports

(Notice that only 16% of exports from China are imported by the United States. China has diversified where their exports go. This means that China is not critically dependent upon exporting to the US. On the other hand, the US imports a high percentage of our required Critical Minerals from China. Therefore, the US should be careful with tariffs & trade policies aimed at China to avoid serious backlash from China whereby they might shut down our access to these critical minerals. — RAD)

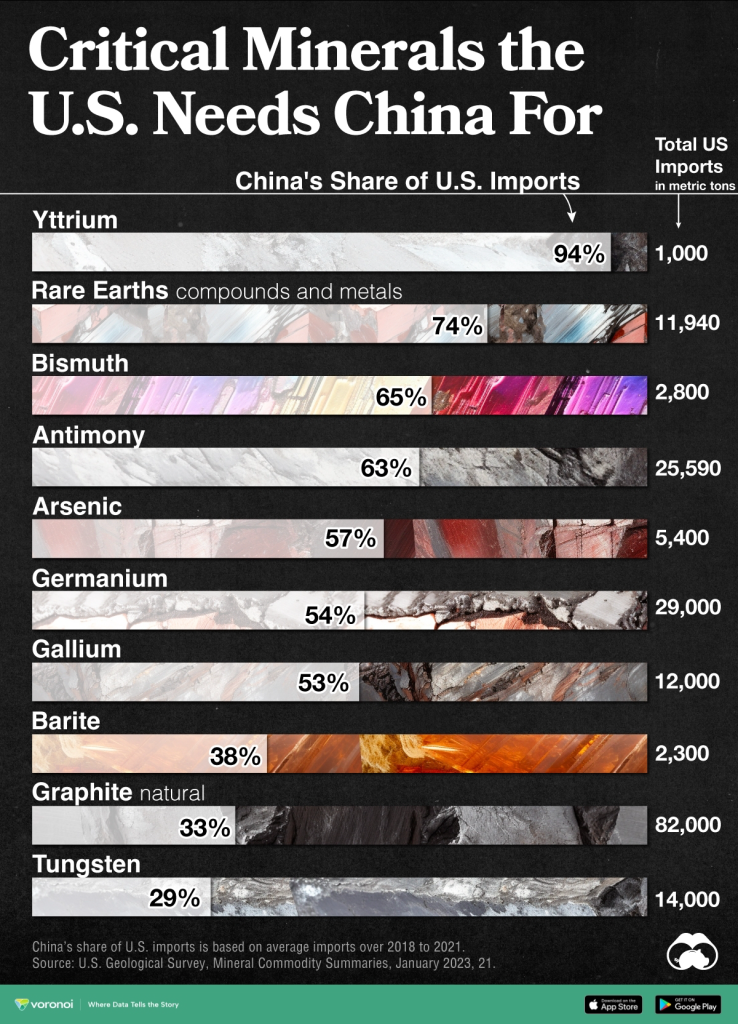

China Dominates the Supply of U.S. Critical Minerals List

by Marcus Lu [1-8-2024].

Most countries have, for many decades, kept a record of their own critical minerals list.

For example, the U.S., drew up a list of “war minerals” during World War I, containing important minerals which could not be found and produced in abundance domestically. They included: tin, nickel, platinum, nitrates and potash.

Since then, as the economy has grown and innovated, critical mineral lists have expanded considerably. The Energy Act of 2020 defines a critical mineral as:

“A non-fuel mineral or mineral material essential to the economic or national security of the U.S., whose supply chains are vulnerable to disruption.” — Energy Act, 2020.

Currently there are 50 entries on this list and the U.S. Geological Survey (USGS) estimates that China is the leading producer for 30 of them. From USGS data, we visualize China’s share of U.S. imports for 10 critical minerals.

What Key Critical Minerals Does the U.S. Import From China?

The U.S. is 100% import-reliant for its supply of yttrium, with China responsible for 94% of U.S. imports of the metal from 2018 to 2021.

A soft silvery metal, yttrium is used as an additive for alloys, making microwave filters for radars, and as a catalyst in ethylene polymerization—a key process in making certain kinds of plastic.

China is a major supplier of the following listed critical minerals to the U.S.

Note: China’s share of U.S. critical minerals imports is based on average imports from 2018 to 2021.

Meanwhile, the U.S. also imports nearly three-quarters of its rare earth compounds and metals demand from China. Rare earth elements—so called since they are not found in easily-mined, concentrated clusters—are a collection of 15 elements on the periodic table, known as the lanthanide series.

Yttrium and scandium exhibit similar rare-earth properties, and are found in the same ore bodies. They are often grouped together with the lanthanide series.

Rare earths are used in smartphones, cameras, hard disks, and LEDs but also, crucially, in the clean energy and defense industries.

Does China’s Dominance of U.S. Critical Minerals Supply Matter?

The USGS estimates that China could potentially disrupt the global rare earth oxide supply by cutting off 40–50% production, impacting suppliers of advanced components used in U.S. defense systems.

A version of this sort of trade warfare is already playing out. Earlier this year, China implemented export controls on germanium and gallium. The U.S. relies on China for around 54% of its demand for both minerals, used for producing chips, solar panels, and fiber optics.

China’s controls were seen as a retaliation against the U.S. which has restricted the supply of chips, chip design software, and lithography machines to Chinese companies.