China’s Trade Ascendancy: Outmaneuvering a Declining U.S. in a Multipolar World

by Angelo Giuliano [3-19-2025 published].

(If China hadn't developed into a manufacturing & engineering powerhouse, the US wouldn't be concerned. When you take a closer look at why a lot of the US manufacturing has left for China and other places, a lot can be attributed to US short sighted policies that facilitated moving important manufacturing out of the United States. I've worked in companies that supported engineering & manufacturing, so I understand that it would be next to impossible to duplicate key Chinese manufacturing niches in the US.

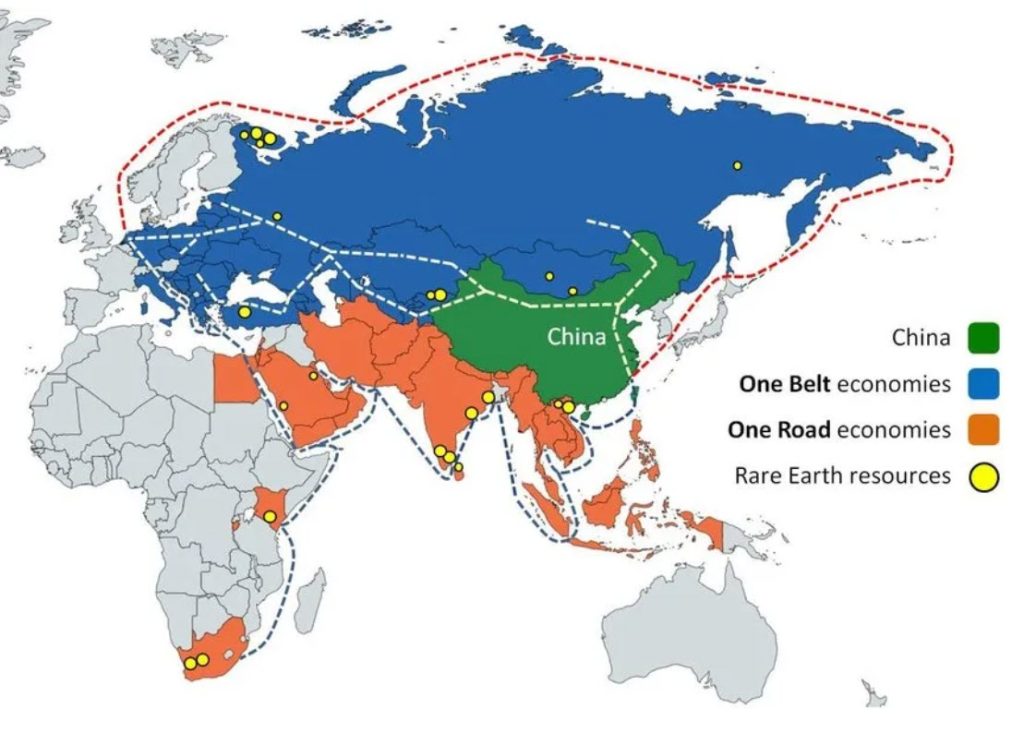

As this article rightly points out, China's Belt & Road Initiative has insulated China from many shipping restrictions that the US wants to impose.

Wouldn't it be much better for the US to acknowledge China's manufacturing capabilities and learn where we should focus our efforts to enhance specific manufacturing capabilities key to our defense and critical infrastructure? Spend our resources this way instead of wasting money trying to constantly stop China, which is a losing game? — RAD)

China’s economic prowess is a global marvel, driven by maritime trade that powers its dominance. Approximately 60% of its annual trade value—trillions of dollars—crosses the seas, brimming with oil, natural gas, raw materials, and exports that flood international markets. The United States, scrambling to preserve its fading hegemony, sees this as a vulnerability, plotting to choke China’s lifelines at key maritime passages with carrier groups, submarines, and missiles, all under the pretext of “securing trade routes.” Yet, China’s Belt and Road Initiative (BRI) flips the script, weaving a network of land routes, ports, and alliances that render these threats impotent. U.S. alliances, once a bedrock of strength, are faltering—America’s abrupt pivot from Ukraine to China in 2025, leaving Kyiv to face Russia alone, has allies like Japan, the Philippines, and Gulf states questioning Washington’s reliability. Tariffs slamming over $500 billion in Chinese goods annually aren’t a display of power; they’re a desperate attempt to reduce U.S. dependence on China, only bolstering Beijing’s resilience. Current tensions—trade wars, technology bans, and South China Sea standoffs—escalate daily, but Trump’s moves to seize control of the Panama Canal and speculate on acquiring Greenland, increasingly guided by the Mearsheimer school of thought, flounder against China’s steady rise. John Mearsheimer’s offensive realism—where states must aggressively amass power in an anarchic world to survive—shapes Trump’s hardline approach, but BRI proves China’s already outpaced the U.S. in this multipolar era.

The U.S. might fantasize about targeting the Strait of Malacca, that narrow channel between Malaysia and Sumatra where 40% of global trade, including 80% of China’s oil from the Middle East and Africa, flows. It could deploy its naval arsenal and lean on regional players economically, but BRI’s ports in Malaysia and rail lines stretching across Asia diminish Malacca’s chokehold to a minor nuisance. Singapore, bound to the U.S. through the Strategic Framework Agreement, hosts American ships, while the Quad—U.S., Japan, India, Australia—looms with Australia’s Indian Ocean presence and India’s Andaman and Nicobar Islands. Yet, these partners hesitate. The U.S. abandoning Ukraine has left them wary—why stake their futures on a power that drops allies when the stakes rise? BRI’s economic arteries offer a more reliable lifeline, and multipolarity tips the scales toward China.

In the South China Sea, a crucial link to Southeast Asia, Europe, and the Americas, the U.S. stirs the pot with naval patrols, air and missile threats, and notions of blockading China’s reclaimed Spratly Islands. It leans on the Philippines’ Subic Bay via the Mutual Defense Treaty, Vietnam’s resistance, and Quad allies Japan and Australia. But this isn’t a weak spot—it’s China’s stronghold. BRI’s roads, railways, and ports across Thailand and Myanmar ensure trade keeps moving, no matter the U.S. posturing. ASEAN nations, once inclined toward America, now weigh BRI’s tangible benefits against a U.S. undermined by tariffs and the Ukraine pivot. Tensions—warships prowling, sanctions tightening—fill the air, but China stands firm, its regional ties strengthened by multipolar pragmatism.

The Taiwan Strait, pulsing with trade and tension between the mainland and Taiwan, is another U.S. pipe dream. America could station forces east of Taiwan, arm it with missiles through the Relations Act, and tap Japan and South Korea from Okinawa and the Yellow Sea. BRI’s China-Pakistan Economic Corridor and Eurasian rail networks, however, turn this into a trivial hurdle—trade bypasses the strait with ease. Japan and South Korea, burned by Ukraine’s fate, see the multipolar tide; tariffs push the U.S. away from Chinese goods, but Beijing’s economic pull grows amid tech bans and trade spats. China remains unshaken.

Oil flows through the Strait of Hormuz, 20-30% of the global supply, 38% for China. The U.S., with its Bahrain fleet, might attempt patrols, tanker inspections, or sanctions, backed by Gulf allies, the UK, and Israel. BRI counters with Central Asian pipelines and Gulf partnerships—China’s energy stays secure. Gulf states, once U.S. stalwarts, now play multipolar chess; BRI’s infrastructure cash outweighs a U.S. weakened by Ukraine and tariffs. Tensions simmer, but China’s oil is locked in.

Trump’s push to reclaim the Panama Canal, tied to historical treaties, seeks to hinder Chinese ships with tolls, backed by Colombia—a strike at BRI’s Latin ports like Chancay. Mearsheimer’s offensive realism fuels this—states must hoard power in anarchy, and Trump’s betting on choke points to slow China. But Panama sees tariffs as U.S. frailty, not strength; BRI’s regional foothold outshines this reach. The Ukraine shift deepens skepticism—America’s resolve looks shaky.

Speculation about Trump acquiring Greenland targets the Arctic, where BRI’s “Polar Silk Road” carves new paths as ice melts. Mearsheimer’s lens—maximize power, dominate rivals—drives this chatter, imagining U.S. control blocking China. It’s speculative—Denmark, drawn by BRI’s Arctic ventures, eyes a U.S. faltering post-Ukraine. Tensions—sanctions, tech wars—don’t alter the math; China’s northern plans advance.

The U.S. clings to the Quad, AUKUS, and ASEAN, but they’re fracturing. Multipolarity reigns—nations chase self-interest. Tariffs spark China’s innovation, not collapse. The U.S. pivot from Ukraine to China reeks of retreat. Trump’s moves, rooted in Mearsheimer’s realism, falter against BRI’s trillion-dollar web. China’s steering this era, turning U.S. threats into echoes of a bygone time.