Beijing vows to protect itself from US economic ‘bullying’

Workers monitor the production of electronic chips at a factory in Chongqing, China, May 9, 2023 © Getty Images

by RT [12-2-2024 published].

(Here we have more examples about how 'stupid' it is on the part of the United States to apply tariffs & try to restrict certain products to be used by nations that the US considers 'unfriendly'. Yes, in the short term it can cause pain for the targeted countries. But in the longer run those countries are going to find more & more ways to divorce themselves from those US products. The US needs to seriously rethink its strategies about interacting with other nations. A good place to start would be to examine why so many countries want to join the BRICS nations. Maybe it is time to start focusing on how to better get along with other nations? — RAD)

Washington has restricted the export of a broad range of chipmaking tools and software to China.

China’s Ministry of Commerce has vowed to take “necessary measures” to safeguard its interests after the US imposed sweeping export controls aimed at crippling the Chinese semiconductor industry.

The US Department of Commerce announced on Monday that it would ban the export of 24 types of chip manufacturing equipment, three software programs, and high bandwidth memory to China. Additionally, 140 Chinese entities – including toolmakers, chip fabricators, and investment firms – were added to the department’s blacklist over their role in developing China’s domestic semiconductor industry.

In a statement, the Commerce Department claimed that Chinese semiconductors “can be used in the next generation of advanced weapon systems and in artificial intelligence,” which “pose a substantial risk to US national security.”

“This is a typical act of economic coercion and non-market practice,” a spokesperson for the Chinese ministry said in response. “The US says one thing and does another… abusing export control measures, and implementing unilateral bullying. China firmly opposes this.”

The spokesperson observed that the “semiconductor industry is highly globalized,” and said that unilateral actions like those taken by the US hinder free and open trade between other nations.

“China will take necessary measures to resolutely safeguard its legitimate rights and interests,” they concluded.

China’s semiconductor industry has been targeted by successive US administrations, with Donald Trump banning the export of certain chipmaking equipment to Semiconductor Manufacturing International Corp (SMIC), China’s top chip manufacturer, during his first term in office. President Joe Biden imposed two further rounds of export controls, while allocating tens of billions of dollars to boost the production of semiconductors in the US.

The White House has also held talks with Japan, South Korea, and Taiwan aimed at formalizing the so-called ‘Chip 4 Alliance’, which Beijing sees as an attempt by Washington to “dominate the global semiconductor production and supply chain.”

Despite this pressure campaign, SMIC succeeded two years ago in machining chips to the highest Western standards. This breakthrough came despite Dutch and Japanese toolmakers being forbidden by Washington from supplying SMIC with their most advanced tools.

Related

US could ban Russian and Chinese car software – media [9-22-2024]

China strikes back against US ‘weaponizing’ of trade

by RT [12-3-2024 published].

Beijing has responded to Washington-imposed curbs by restricting exports of key rare metals and some dual-use items.

China has announced a ban on shipments to the US of several dual-use items and key raw materials used in semiconductor manufacturing and military applications. The move comes in response to the latest US sanctions.

On Monday, Washington unveiled restrictions on the export of a broad range of chipmaking tools and software to the Asian nation.

According to a statement issued by the Chinese Ministry of Commerce (MOFCOM) on Tuesday, the retaliatory measures have been introduced in order to safeguard national security interests and fulfill international obligations.

Under the new regulation, China will prohibit the export of dual-use items to US military users or for military purposes. It will also strictly control the export of gallium, germanium, antimony, and superhard materials, as well as graphite-related dual-use items to the US.

The listed rare metals are used in the making of computer chips and a variety of other products, such as solar panels and advanced radar equipment. China is the world’s top producer of gallium and is a leading exporter of germanium.

The US hasn’t produced any gallium since 1987 and relied on China for 21% of its imports of the material between 2019-2022, according to the US Geological Survey. Imports more than halved when compared to previous years due to higher tariffs slapped on shipments to the US by Beijing.

The MOFCOM warned that any organization or individual from any country or region that violates new regulations will be held accountable in accordance with the law. The regulation comes into effect immediately.

The US Department of Commerce announced on Monday that it would ban the export of 24 types of chip manufacturing equipment, three software programs, and high bandwidth memory to China. Additionally, 140 Chinese entities – including toolmakers, chip fabricators, and investment firms – were added to the department’s blacklist over their role in developing China’s domestic semiconductor industry.

Commenting on the issue, a MOFCOM spokesperson told reporters on Tuesday that in recent years, the US “has overstretched the concept of national security, politicized and weaponized economic and technological issues, abused export control measures…”

Such practices seriously undermine international trade rules, the legitimate rights and interests of enterprises, as well as the stability of global industrial and supply chains, the spokesperson said.

The world’s two largest economies, the US and China, have in recent years been jostling for domination in key technology areas, including semiconductors. Washington has repeatedly tightened export controls to prevent Chinese firms from buying certain American components, citing risks to national security.

Beijing has slammed the export curbs, claiming that they run counter to globally recognized market rules.

Zinc Price Swings Offer Taste of US Tariff-At-Any-Cost Gamble Targeting China

by Svetlana Ekimenko [12-2-2024 posted].

US President-elect Donald Trump has repeatedly criticized China's economic policies and recently threatened to add an additional 10% tariff on all goods from the Asian giant.

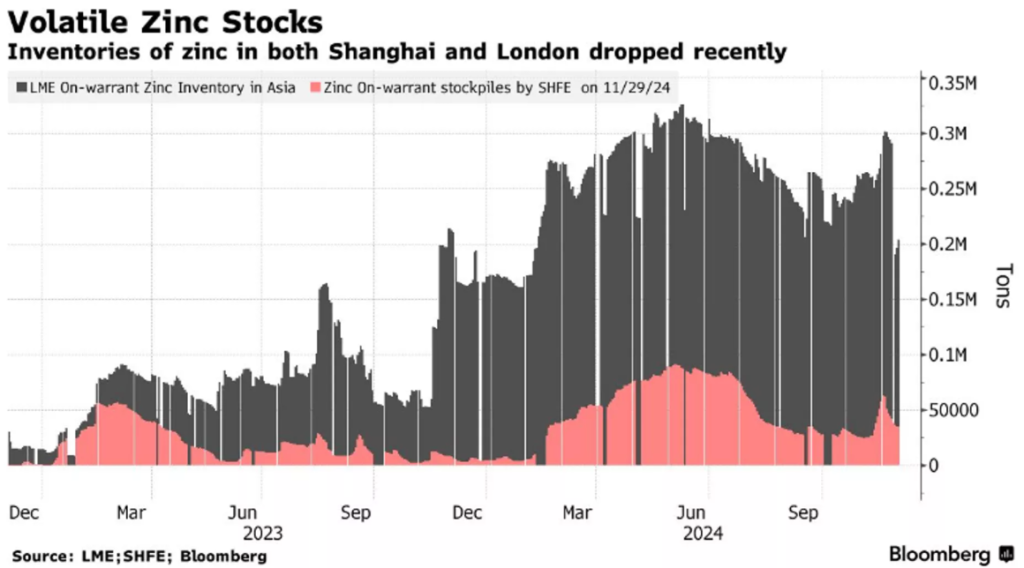

Zinc’s recent price swings reflect the supply pressures of the critical metal that are likely to spill over into 2025, Bloomberg cited analysts as saying.

On November 28, zinc prices fell by 2.5%, only to rebound and finish nearly 5% higher on the London Metal Exchange (LME). However, by December 1, the price dropped again, settling at $3,089.50 per ton, a decline of 0.4%.

Screenshot showing volatile zinc stocks.

The wave of turbulence on the volatile zinc market offers a taste of potential fallout from US President-elect Donald Trump’s threat to slap additional 10% tariffs on all goods from China.

The Asian giant dominates the global market of the rare earth metal, with an annual zinc output of 4.2 million metric tons.

Should there be any further flare-ups in the US-China trade feud, this would likely impact both the supply and pricing of this key industrial metal, which is primarily used for corrosion resistance in steel. Additionally, zinc oxide plays a crucial role in the semiconductor industry, particularly in electronic devices.

The recent surge in prices was fueled by one of the largest withdrawals of zinc from the LME in over a decade. On the Shanghai Futures Exchange, inventories fell by more than 9,000 tons, reflecting a similar decline in London, attributed to take-out orders from the Trafigura Group, a global trading giant.

Worldwide demand for refined zinc is projected to increase by 1.6% to 14.04 million tons in 2025, according to the International Lead and Zinc Study Group.

Related

Neither China, Nor US Will Benefit From Waging Trade War [11-26-2024]